Norway, a land synonymous with breathtaking fjords and a progressive embrace of renewable energy, presents a unique and increasingly attractive landscape for cryptocurrency mining. While Bitcoin and other digital currencies navigate regulatory shifts and environmental scrutiny globally, Norway’s stable political climate, abundant hydropower, and competitive energy prices offer a compelling investment proposition, particularly through strategic mining partnerships.

The allure of Norwegian fjord mining stems from several key advantages. Hydropower, a clean and sustainable energy source, forms the backbone of Norway’s electricity grid. This translates to significantly lower operational costs for mining facilities compared to regions reliant on fossil fuels. Furthermore, the cold climate provides natural cooling, reducing the need for expensive and energy-intensive cooling systems, a significant cost factor in traditional mining operations. This combination of inexpensive and green energy drastically improves the profitability and environmental footprint of crypto mining endeavors.

Beyond the environmental and economic incentives, Norway boasts a robust regulatory environment that encourages innovation and technological advancement. The Norwegian government has adopted a balanced approach to cryptocurrency, recognizing its potential while also emphasizing the need for responsible regulation to protect investors and prevent illicit activities. This clarity provides a stable and predictable operating environment for mining businesses, fostering long-term growth and investment.

However, navigating the complexities of establishing and operating a mining facility in Norway requires local expertise and strategic partnerships. This is where investment opportunities in Norwegian fjord mining partnerships become particularly appealing. These partnerships offer a streamlined entry point for investors seeking to capitalize on the advantages of Norwegian mining without the burden of navigating regulatory hurdles, securing land permits, and managing infrastructure development independently.

These partnerships often involve established Norwegian companies with deep knowledge of the local energy market, regulatory framework, and infrastructure. They provide access to pre-existing infrastructure, including data centers, power connections, and cooling systems, significantly reducing upfront capital expenditures and accelerating the time to market. Furthermore, they offer expertise in navigating the complexities of Norwegian regulations, ensuring compliance and minimizing the risk of operational disruptions.

The potential returns on investment in Norwegian fjord mining partnerships are compelling, driven by the combination of low operating costs, a stable regulatory environment, and access to clean energy. Bitcoin, Ethereum, and other cryptocurrencies that rely on energy-intensive proof-of-work algorithms stand to benefit most from this model. While Dogecoin utilizes a less energy-intensive algorithm, the overall stability and positive investment climate of Norway can still be attractive for mining operations focused on alternative cryptocurrencies.

The specific structure of these partnerships can vary, ranging from joint ventures to equity investments, providing flexibility for investors with different risk appetites and investment horizons. Due diligence is crucial, however, to ensure the partner company has a proven track record, a strong understanding of the cryptocurrency market, and a commitment to sustainable mining practices.

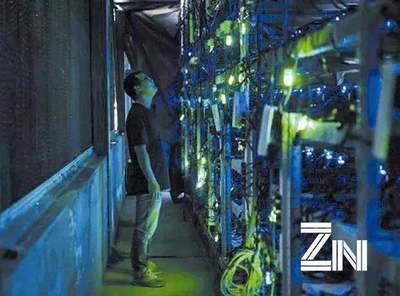

Mining rigs are the backbone of any cryptocurrency mining operation, and selecting the right equipment is essential for maximizing efficiency and profitability. Partnerships often provide access to state-of-the-art mining rigs optimized for specific cryptocurrencies, further enhancing the potential returns on investment. The hosting of these mining rigs within established and well-maintained facilities also minimizes downtime and ensures optimal performance.

Moreover, the growth of the cryptocurrency market and the increasing demand for decentralized financial services are driving innovation in mining technology. New generations of mining machines are more energy-efficient and powerful, further enhancing the profitability of Norwegian fjord mining operations. The long-term outlook for cryptocurrencies remains positive, supported by growing adoption and institutional interest.

In conclusion, investment opportunities in Norwegian fjord mining partnerships offer a compelling blend of environmental sustainability, economic viability, and regulatory stability. By leveraging Norway’s abundant hydropower resources and strategic local partnerships, investors can gain exposure to the burgeoning cryptocurrency market while minimizing risk and maximizing returns. As the demand for decentralized digital currencies continues to grow, Norway’s unique advantages position it as a prime location for sustainable and profitable cryptocurrency mining operations.

One response to “Investment Opportunities in Norwegian Fjord Mining Partnerships”

Norwegian fjord mining partnerships: A risky but potentially lucrative plunge into the earth’s depths, promising high returns amidst stunning landscapes and complex regulations. Dig in cautiously.