The allure of Bitcoin, a digital gold rush reimagined for the 21st century, continues to captivate investors and tech enthusiasts alike. But beyond the headlines and price charts lies a complex ecosystem, a landscape dominated by the unsung heroes of the cryptocurrency world: the miners. Their powerful machines, humming day and night, validate transactions and secure the Bitcoin network. Choosing the right hardware isn’t just a matter of profitability; it’s about participating in a decentralized revolution responsibly and efficiently.

Diving into the world of Bitcoin mining can feel like navigating a technological labyrinth. ASICs (Application-Specific Integrated Circuits) reign supreme, purpose-built for the computationally intensive task of solving cryptographic puzzles. Forget using your gaming PC; these specialized machines are the only viable option for competitive Bitcoin mining. But with a plethora of models available, each boasting different hash rates, power consumption figures, and price tags, where do you even begin?

Hash rate, measured in terahashes per second (TH/s), is the key performance indicator. It reflects the machine’s ability to solve those complex puzzles and earn Bitcoin rewards. The higher the hash rate, the greater the potential earnings. However, don’t be solely fixated on this number. Power consumption is equally crucial. A high hash rate machine guzzling electricity will quickly erode your profits. Efficiency, measured in joules per terahash (J/TH), is the metric to watch, indicating how much energy the machine requires to perform a unit of hashing power.

Beyond the hardware itself, location, location, location! Access to cheap electricity is paramount. Regions with surplus renewable energy, like Iceland and parts of China (though regulatory shifts have impacted the landscape), have historically been hotspots for mining operations. This brings us to the concept of mining machine hosting. For those without the resources or expertise to manage their own mining farm, hosting providers offer a turnkey solution. They provide the infrastructure, cooling, and maintenance, allowing you to focus on the rewards, not the headaches.

Choosing a reputable hosting provider is critical. Look for providers with robust security measures to protect your hardware from theft or damage, reliable uptime to ensure consistent mining, and transparent pricing structures with no hidden fees. Consider the provider’s geographical location and the cost of electricity in that region. A seemingly cheap hosting package can quickly become expensive if the electricity costs are exorbitant.

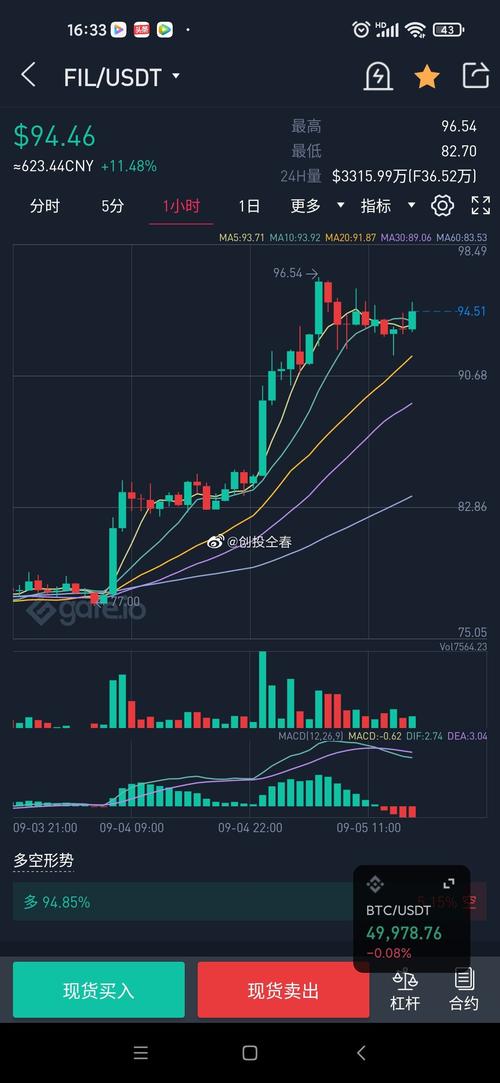

The cryptocurrency market is a volatile beast, and mining profitability is directly tied to Bitcoin’s price. A sudden price drop can render even the most efficient mining hardware unprofitable. Therefore, it’s crucial to conduct thorough research and factor in price fluctuations when evaluating the ROI (Return on Investment) of a mining rig. Diversifying your cryptocurrency portfolio, exploring other mineable coins, or hedging your bets with futures contracts can mitigate the risks associated with Bitcoin’s volatility.

Beyond Bitcoin, other cryptocurrencies utilize different mining algorithms. Ethereum, before its transition to Proof-of-Stake, relied on the Ethash algorithm, making it mineable with GPUs (Graphics Processing Units). Litecoin uses Scrypt, which is less energy-intensive than Bitcoin’s SHA-256, opening the door to potentially more accessible mining opportunities. However, the profitability and security of these alternative cryptocurrencies are subject to their own unique set of challenges and require careful consideration.

The ethical considerations surrounding Bitcoin mining are also gaining increasing attention. The energy consumption of the Bitcoin network is a legitimate concern, driving the search for more sustainable mining practices. Utilizing renewable energy sources, optimizing mining hardware for maximum efficiency, and exploring alternative consensus mechanisms are all crucial steps toward a greener and more responsible future for cryptocurrency.

In conclusion, securing and efficiently mining Bitcoin requires a holistic approach. It’s not just about buying the most powerful hardware; it’s about understanding the economics of mining, mitigating the risks associated with cryptocurrency volatility, and embracing sustainable practices. Whether you choose to build your own mining rig, utilize a hosting provider, or explore alternative cryptocurrencies, due diligence and informed decision-making are paramount to success in this dynamic and ever-evolving landscape.

The future of Bitcoin mining is uncertain, with regulatory changes, technological advancements, and evolving environmental concerns constantly reshaping the industry. Staying informed, adapting to change, and prioritizing security and sustainability will be crucial for those seeking to thrive in this challenging yet potentially rewarding sector.

One response to “The Ultimate Guide to Secure and Efficient Bitcoin Mining Hardware”

This guide masterfully demystifies Bitcoin mining hardware, blending cutting-edge security tips with efficiency hacks—think ASIC defenses and eco-friendly rigs—that could unpredictably boost your yields and thwart cyber threats!